Convertible Bond Arbitrage Using the Volatility Surface

Convertible bonds are complex, hybrid securities.

In finance, a convertible bond or convertible note or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. It originated in the mid-19th century, and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering. Read more

Previous studies have established a formal link between a bond’s credit spread and equity options’ volatilities [1]. A recent article [2] went further and linked a convertible bond’s implied volatilities to listed equity volatilities.

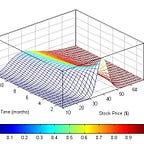

Initially, a risk neutral mark-to-market methodology was proposed. This required marking to the traded bond price and implying the volatility from the embedded option. Linking the CB implied volatility to listed option implied volatilities created a new long-dated volatility term structure. Typically, implied volatilities decrease with tenor. With CBs representing maturities that are much longer than exchange traded volatilities, the magnitude of CB implied volatilities signaled the relative value. If the CB is issued at an implied volatility below listed volatilities, the expectation is that the CB implied volatility will increase, or converge, to the listed volatilities as the bond seasons. The resultant increase in CB implied volatility translates to a P&L gain for the delta hedged position. Nevertheless, CBs are not necessarily issued with implied volatilities that agree with an issuers term structure. In fact, CB implied volatilities can print well through shorter dated volatilities.

A volatility surface for the convertible was constructed and used in a convertible arbitrage strategy. The authors reached some interesting conclusions.

- The results indicate that there is a mispricing, but it is not an underpricing as widely reported but rather an overpricing.

- The profitability of the strategy was shown to largely depend on avoiding rich bonds and delta hedging those bonds with a well-defined, or consistent, implied volatility term structure.

- The common contention that convertible arbitrage is a gamma trading strategy was shown to be incorrect. Arbitrage is a vega trade that is profitable when implied volatilities increase.

References

[1] P. Carr and L. Wu, Simple robust link between American puts and credit protection, The Review of Financial Studies, 2011, p. 473

[2] P.J. Zeitsch, M. Hyatt, T.P. Davis, X. Liu, Convertible Bond Arbitrage and the Term Structure of Volatility, The Review of Financial Studies (2020), submitted

Article Source Here: Convertible Bond Arbitrage Using the Volatility Surface