How to Determine Implied Dividend Yield-Derivative Valuation in Excel

Dividend yield is an input into the option valuation model that often receives little attention from the practitioners. This is probably because the majority of companies do not pay dividends. And for those that pay, an inaccuracy in the estimation of the dividend yield often has a small impact on the fair value of the financial instrument, especially if the tenor of the instrument is short.

However, under some circumstances, dividend can become an important input in the valuation model, and an inaccurate estimation can lead to a severe financial loss. This is what happened with a French bank during the pandemic,

The bank also lost about 100 million euros on dividend futures for the quarter, the people said. The losses had surged at one point to about 300 million euros before improving, according to the people. Dividend futures are derivatives that investors use to speculate on the payouts that companies make to shareholders. They have tumbled to historic lows in recent weeks as some of the world’s biggest corporations shred their awards in response to the coronavirus and, in some industries, pressure from regulators. Read more

In this post, we discuss ways to determine the dividend yield accurately. In the option pricing model, the most accurate dividend yield is the implied one that can be calculated from

- Dividend futures,

- Traded single stock futures, or

- Traded options.

We’re not going to discuss dividend futures here as they are over-the-counter instruments and not traded frequently. Single stock futures, on the other hand, have been traded more frequently than dividend futures, but they are illiquid and the number of available single stock futures is still small.

This leaves us with the last choice, i.e. using traded options to determine the implied dividend yield. Specifically, if the options are of European-style exercise, then we can use the put-call parity to create a synthetic single stock future, i.e.

where C(K,t) is the call price at time t,

P(K,t) denotes the put price,

K is the strike price,

S is the stock price,

r is the risk-free rate,

T is the time to maturity, and

q is the continuous dividend yield.

Note that equation (1) is model-free, and the implied dividend yield can be extracted easily by using it. This method has been implemented in an Excel spreadsheet.

As an example, we are going to calculate the implied dividend for Microsoft (MSFT) as of Feb-26–2021. The picture above shows the price of the 6-month call option with a strike price of $240. The price of the put option, as well as the risk-free rate, are provided in the Excel spreadsheet.

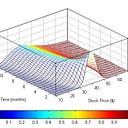

The picture below shows the calculated implied dividend yield from MSFT traded option prices. We obtain an implied dividend yield of 0.72%.

Note that in the above example, for illustration purposes we assumed that the options are European style, but in fact they are American style, as is the case for most equity options. This means that the put-call parity no longer holds, and we cannot use eq (1) to calculate the implied dividend yield.

Fortunately, there is a viable solution. Reference [1] presents a method that generalizes the put-call parity for the case of American options. Essentially, the author introduces a so-called early exercise premium into equation (1), thus allowing the generalized put-call parity relationship continues to be used in the calculation of the implied dividend yield.

A novel element in this methodology is that it clears the hurdle of dealing with the early exercise premium that is not present in index options but is an element of value in American style options of US stocks. The Cox, Ross and Rubinstein (1979) binomial tree takes account of this premium and the tree is constructed simultaneously for a pair of put and call options with otherwise equal characteristics by guessing the same values for implied dividends and implied volatilities for the put and call pricing models. Analyzing dividends from stock options thus implied reveals their predictive power and adds to the understanding of cross-sectional stock returns.

Click on the link below to download the Excel spreadsheet.

References

[1] J, Kragt, Option Implied Dividends, https://ssrn.com/abstract=2980275

Post Source Here: How to Determine Implied Dividend Yield-Derivative Valuation in Excel